Pixalate's Connected TV (CTV) Ad Supply Trends Report 2020, offers an in-depth look at programmatic CTV advertising throughout 2020.

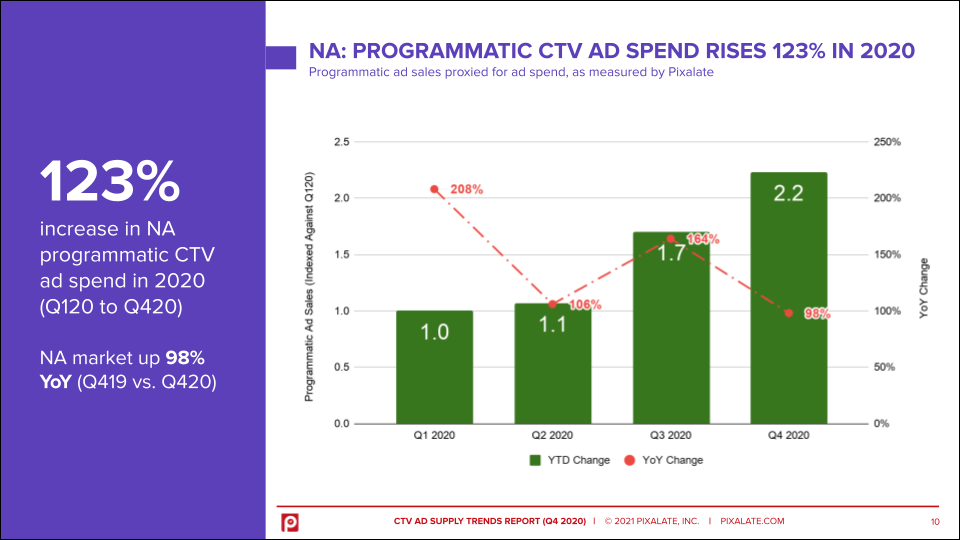

The report analyzes programmatic CTV ad spend trends in 2020, which was a big year for CTV as the COVID-19 pandemic shutdowns kept consumers at home for much of the year.

This blog details how the North American programmatic CTV ad market made its way through 2020.

North America's programmatic CTV ad market increased 123% in 2020, when comparing Q120 to Q420.

What's inside the report

Pixalate's 2020 Connected TV Ad Spend Supply Trends Report includes:

Download a free copy of the report here: 2020 Connected TV Ad Spend Supply Trends Report.

Disclaimer

The content of this blog, and the Connected TV (CTV) Ad Supply Trends Report 2020 (the "Report"), reflect Pixalate's opinions with respect to factors that Pixalate believes can be useful to the digital media industry. Any insights shared are grounded in Pixalate's proprietary technology and analytics, which Pixalate is continuously evaluating and updating. Pixalate's datasets — which are used exclusively to derive these insights — consist predominantly of open auction programmatic traffic sources. As cited in the Report and referenced in the Report's key findings reproduced herein, programmatic ad transactions, as measured by Pixalate, are used as a proxy for ad spend. The Report examines U.S. advertising activity. Per the Media Rating Council, Inc. (MRC), "'Fraud' is not intended to represent fraud as defined in various laws, statutes and ordinances or as conventionally used in U.S. Court or other legal proceedings, but rather a custom definition strictly for advertising measurement purposes.” Also, per the MRC, "'Invalid Traffic' is defined generally as traffic that does not meet certain ad serving quality or completeness criteria, or otherwise does not represent legitimate ad traffic that should be included in measurement counts. Among the reasons why ad traffic may be deemed invalid is it is a result of non-human traffic (spiders, bots, etc.), or activity designed to produce fraudulent traffic." Any references to outside sources in the Report and herein should not be construed as endorsements. Pixalate's opinions are just that, opinions, which means that they are neither facts nor guarantees.

*By entering your email address and clicking Subscribe, you are agreeing to our Terms of Use and Privacy Policy.

These Stories on CTV

*By entering your email address and clicking Subscribe, you are agreeing to our Terms of Use and Privacy Policy.

Disclaimer: The content of this page reflects Pixalate’s opinions with respect to the factors that Pixalate believes can be useful to the digital media industry. Any proprietary data shared is grounded in Pixalate’s proprietary technology and analytics, which Pixalate is continuously evaluating and updating. Any references to outside sources should not be construed as endorsements. Pixalate’s opinions are just that - opinion, not facts or guarantees.

Per the MRC, “'Fraud' is not intended to represent fraud as defined in various laws, statutes and ordinances or as conventionally used in U.S. Court or other legal proceedings, but rather a custom definition strictly for advertising measurement purposes. Also per the MRC, “‘Invalid Traffic’ is defined generally as traffic that does not meet certain ad serving quality or completeness criteria, or otherwise does not represent legitimate ad traffic that should be included in measurement counts. Among the reasons why ad traffic may be deemed invalid is it is a result of non-human traffic (spiders, bots, etc.), or activity designed to produce fraudulent traffic.”